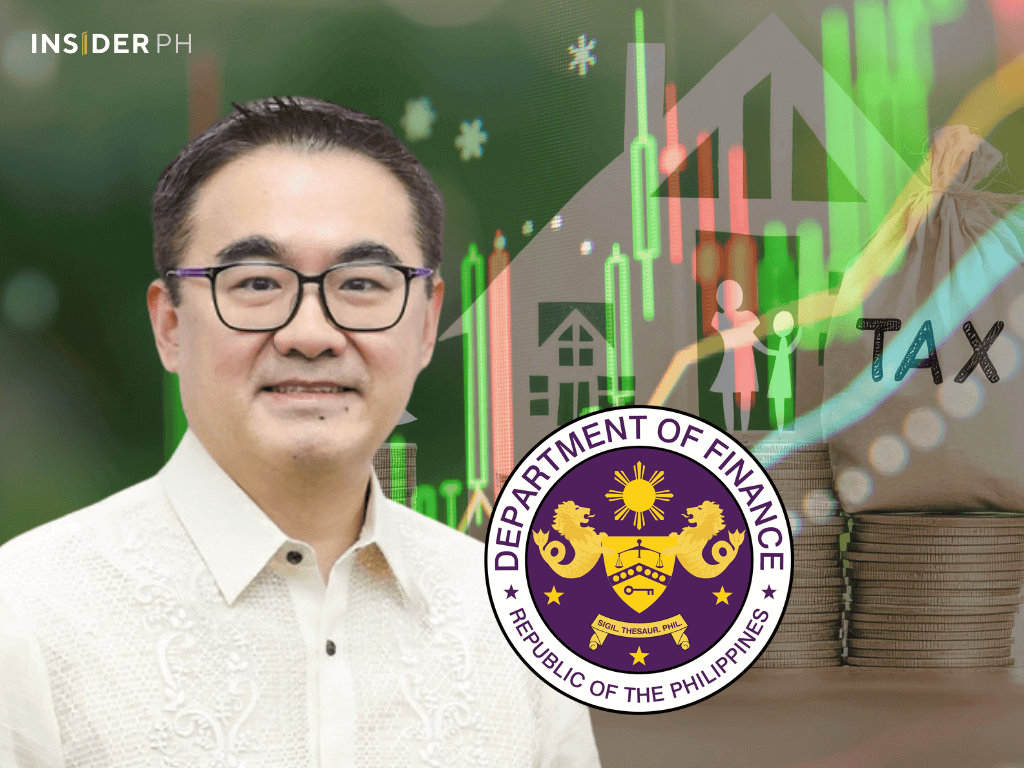

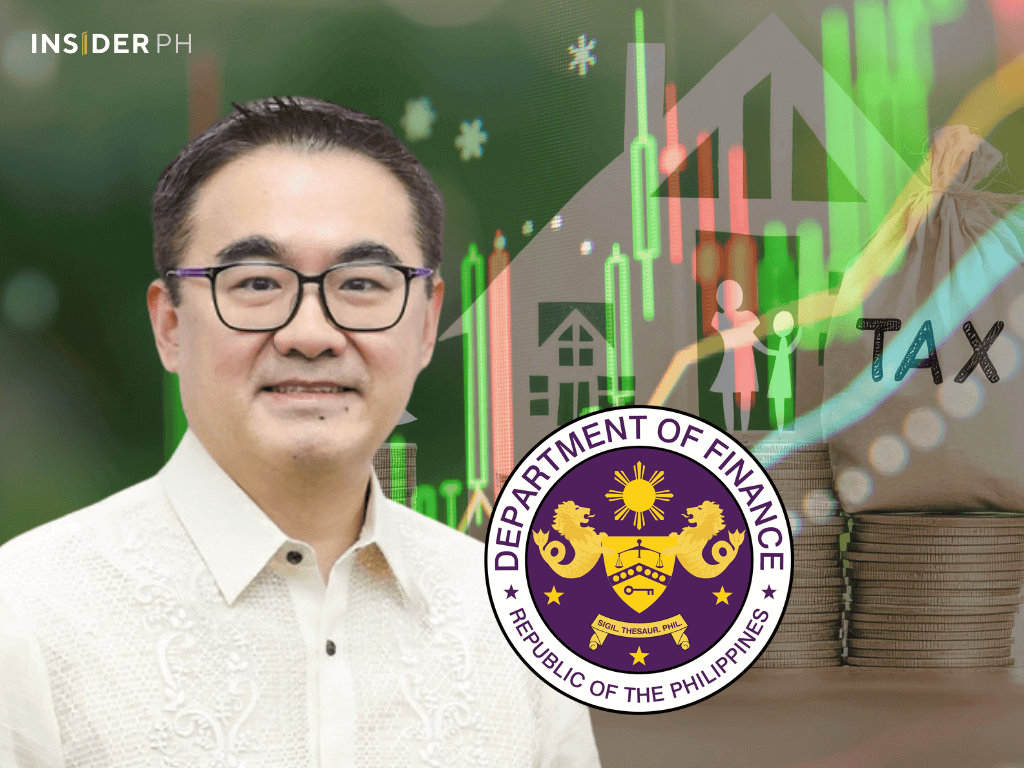

Finance Secretary Frederick D. Go said the measure would help unlock economic value. “This will maximize the use of idle assets and boost productivity,” he noted.

Easing transfer of inherited properties

Under the National Internal Revenue Code (NIRC), estate tax is a one-time payment required for legally transferring a deceased person’s assets to heirs.

The DOF said extending the amnesty would provide relief to families that have long struggled to formalize inheritance due to financial and documentary constraints.

The proposal covers estates of individuals who passed away on or before May 31, 2022, and includes safeguards to prevent misuse.

Ensuring fairness, compliance

To qualify, applicants must complete all requirements and pay the amnesty tax by Dec. 31, 2028.

The bill also permits installment payments over one year from the issuance of the Acceptance Payment Form. Failure to comply will subject estates to penalties and surcharges under the NIRC. —Ed: Corrie S. Narisma