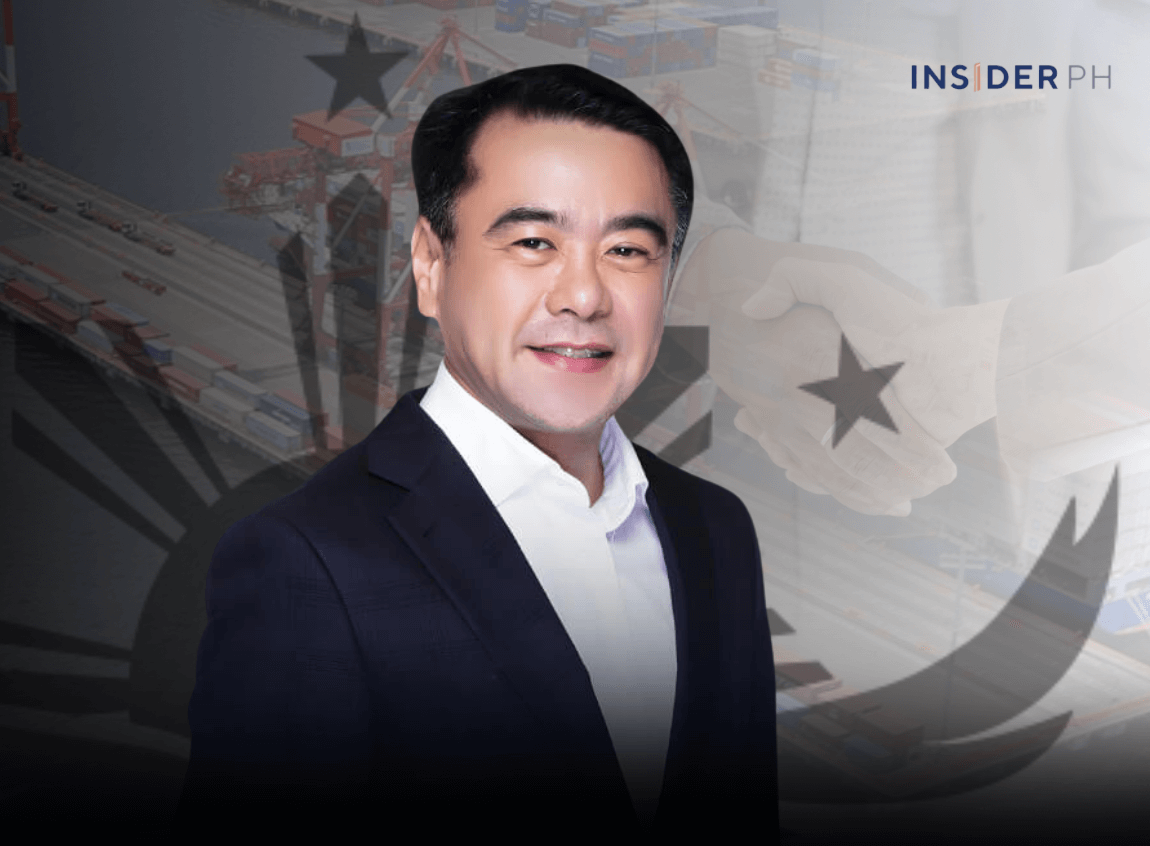

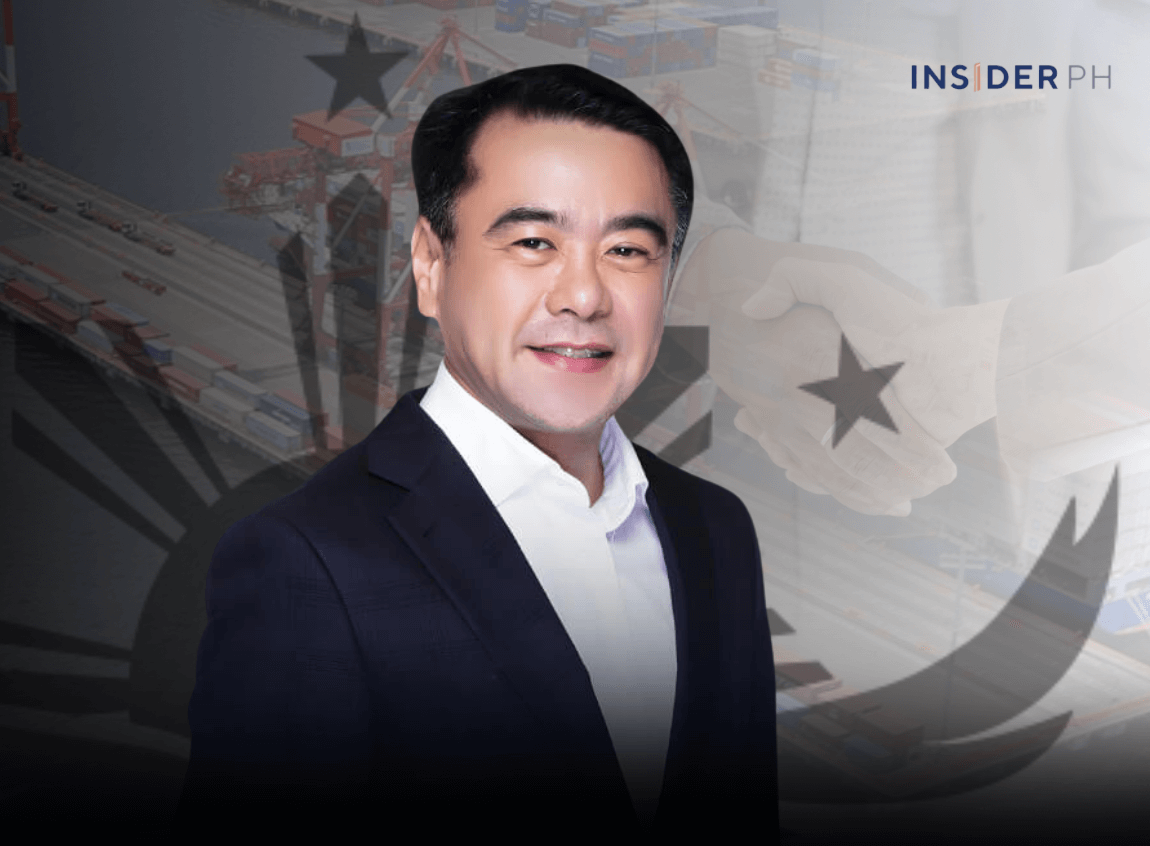

The deal, which also involves a joint tender offer by ATI and Maharlika to acquire all remaining public shares at P36 per share, will result in the delisting of ATI, one of the country’s biggest cargo port operators, on April 3, 2026.

ATI, which is partly owned by Dubai-based logistics giant DP World, operates the Manila South Harbor, Port of Batangas, Tanza Container Terminal and Makar Wharf in General Santos.

The move follows a P6.89-billion tender offer, which kicked off on Feb. 2 and will run through March 3 this year.

Maharlika is joining Asian Terminals itself in the offer to buy 191.44 million minority shares.

The goal is to cross the 95 percent ownership threshold required for voluntary delisting.

Independent valuator MIB Capital Corp. placed ATI’s fair value range at P13.10 to P34.98 per share using four methods, with discounted cash flow at the top of that range.

This means the P36 offer was deemed fair because it is above MIB’s valuation range and ATI’s one-year average trading price.

Maharlika had earlier sought a stake in the National Grid Corp. of the Philippines, but that deal has yet to be closed.

—Edited by Miguel R. Camus