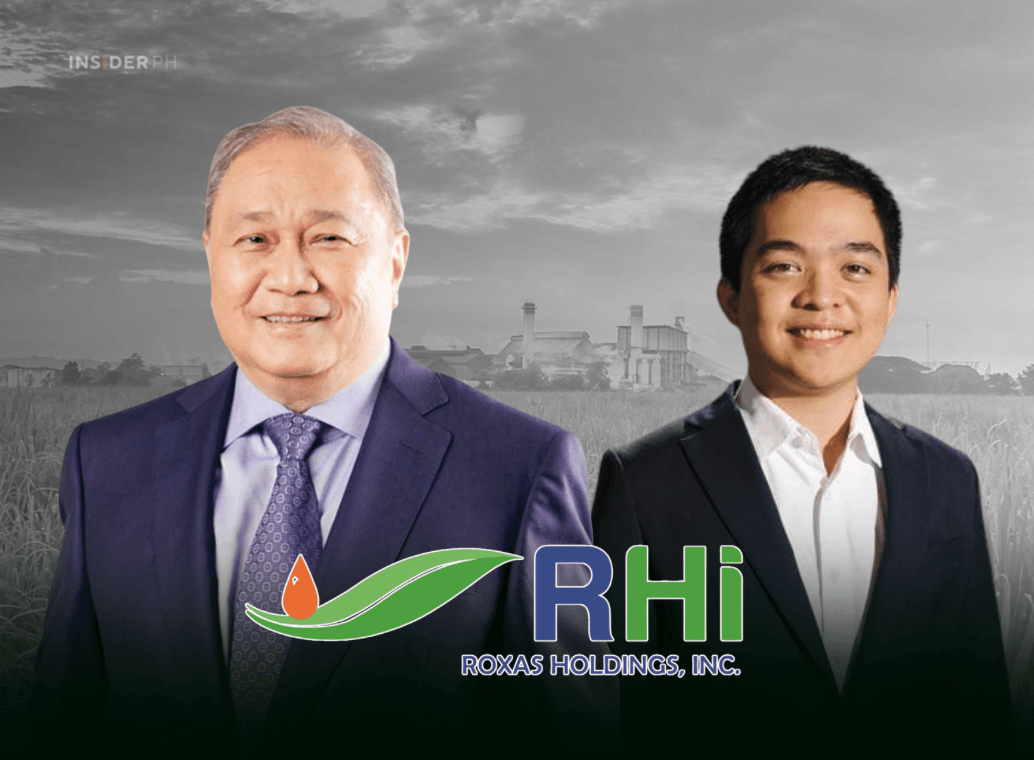

Through Countryside Investments Holdings Corp., Leviste announced in May last year his intention to acquire RHI from tycoon Manuel V. Pangilinan’s First Pacific Group for about P5 billion.

But in an Oct.1, 2025 filing, RHI said final definitive documentation “has not been signed as of this date”.

On again, off again talks

“Discussions on the investment agreement appeared to have been revived this year around June 2025 but unfortunately were subsequently stalled,” RHI said.

“We have no information at this time as to when the discussions on the investment agreement will resume,” the company added.

RHI has been under trading suspension since May 21, 2024, after falling behind on regulatory filings and breaching the Philippine Stock Exchange’s reporting requirements.

Multi-billion peso deal stalls

Leviste had announced the P5-billion takeover in May 2024.

This would have given Countryside a 71.6 percent stake in RHI, which has nearly P6 billion in debts and previously shuttered its century-old Central Azucarera Don Pedro due to heavy losses.

Leviste pitched the infusion as a way to avert bankruptcy, revive RHI’s landholdings in Batangas, and provide new opportunities for farmers and former sugar workers.

His corporate push came before he won a congressional seat in Batangas in the May 2025 elections.

—Edited by Miguel R. Camus