Thursday, 12 February 2026

29 Jan 2026

6:16PM

PSE index slides 2% on growth fears as mining stocks buck broad sell-off

By: Miguel R. Camus

Equity markets usually get a lift at the start of the year as investors put fresh money to work, but 2026 has so far defied that pattern.

29 Jan 2026

4:30PM

Citi sees emerging markets growth, with Philippines in focus

Citi underscored the significant growth potential of emerging markets, particularly the Philippines, while emphasizing the continued resilience of the global economy despite prevailing uncertainties.

16 Jan 2026

2:29PM

PH gov't rolls out ‘big bold reforms’ on taxes, tourism, investments—Finance chief Go

Finance Secretary Frederick Go said the government is rolling out “big, bold reforms” meant to make the Philippines easier to visit, easier to do business in, and more attractive for long-term investment.

7 Jan 2026

11:42AM

Debt, political noise may cap PH’s growth in 2026, Metrobank says

High household debt and lingering political noise are expected to blunt the Philippines’ economic rebound in 2026, even as interest rates fall and growth conditions gradually improve, according to Metrobank Research.

13 Dec 2025

12:40PM

Go calls for stronger EDCom action on prices, growth

Finance Secretary Frederick D. Go urged members of the Economic Development Committee (EDCom) to build on key policy gains and deepen interagency coordination to manage inflation and strengthen investments, as the panel wrapped up its sixth and final meeting for the year on Dec. 11, 2025.

12 Dec 2025

4:46AM

GenSan economy beats national growth as business sector reports big gains

General Santos City closed the past two years with one of the strongest economic showings in the region, posting a 6.8 percent GDP growth rate that outperformed the national 5.6 percent pace and signaled broad momentum for local business.

10 Dec 2025

4:20PM

Philippines set for strong growth as digital and travel sectors rise

The Philippines is expected to remain one of Asia-Pacific’s fastest-growing economies in 2026, powered by robust domestic demand, accelerating digitization and a travel sector that continues to outperform the region, according to the Mastercard Economics Institute’s (MEI) latest outlook.

19 Nov 2025

6:41PM

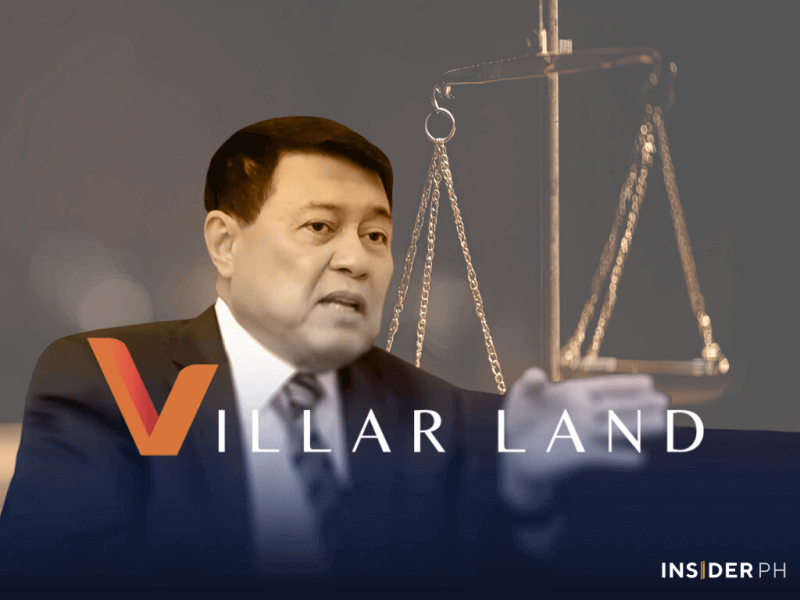

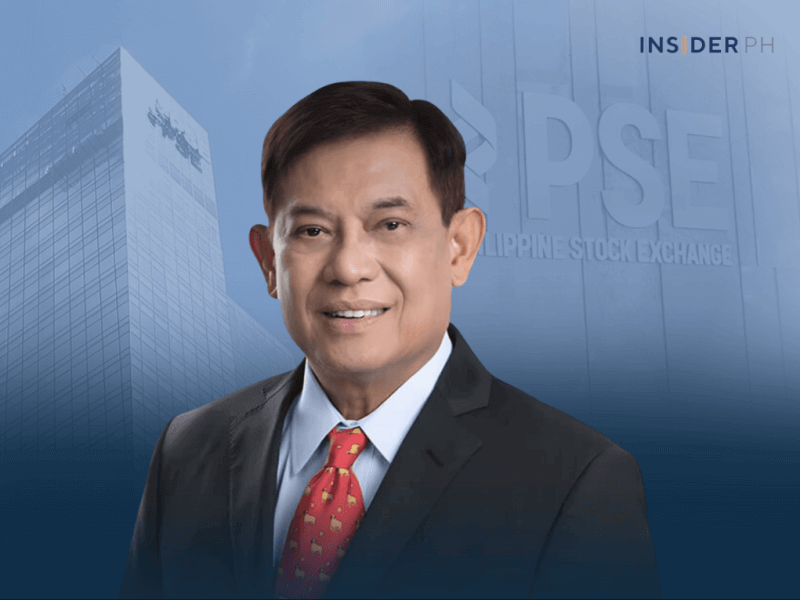

INSIDER INFO: Self-made billionaire weighs PSE delisting amid worsening economic signals

By: Miguel R. Camus

A major tycoon is weighing a possible delisting, reflecting his growing unease over a softening economy.

3 Nov 2025

7:51PM

‘Act before the negative narrative gets worse’: Experts warn of confidence crisis as stock market pain deepens

By: Miguel R. Camus

Philippine stocks extended their slide, nearing recent lows as foreign funds pulled out and confidence wavers amid corruption probes, soft growth signals, and mounting market unease.